At 11:59pm on Wednesday the 25th of March 2020, New Zealand entered a nationwide lockdown to prevent the spread of COVID-19. At the time, headlines about COVID-19's impact on share markets ranged from terrible to catastrophic. Yet, at the time of writing, the US equity market has returned more than 190% since that point in 2020, while the New Zealand share market has returned almost 70% (more on that gap later). Few would have thought or dreamed of this outcome. This remarkable recovery echoes the insights of renowned economist, Elroy Dimson, whose seminal work "Triumph of the Optimists" analysed 101 years of global investment returns.

Dimson's study revealed that shares have consistently outperformed bonds and cash over extended periods, often by substantial margins. This finding supports the current market's resilience and rapid recovery. However, it is crucial to note that Dimson also cautioned against the extrapolation of past performance into the future.

These are some of the lessons we take heed of as we sit down to write our top 10 risks and opportunities for 2025, where our research team debates the issues that might surprise markets in 2025 and perhaps beyond. We hope you find the sharing of our discussion both interesting and useful.

It is important to start with where we are today. On the more positive side of the ledger, companies have given investors reasons to have confidence. Perhaps something we underestimated in our 2024 Top 10 Risks and Opportunities was the level of earnings growth the market could achieve. The other positive, which we think may be overlooked, is the extent that bonds can behave as a portfolio diversifier given most developed economies have inflation within target range, meaning central banks can respond to growth shocks should they occur.

As we head into 2025, the proverbial elephant in the room is the level that valuations have reached within equity markets, with the US market, that makes up around two thirds of the MSCI ACWI Index, hovering at around two-decade valuation highs. High levels of valuation have often preceded large market drawdowns, though valuations themselves have not been the catalyst. Markets often gain confidence to pay a higher multiple for a company when they have high confidence in earnings growth persisting.

That optimism has led to equity market positioning and sentiment entering 2025 at relatively full levels. This confidence permeates through most 2025 outlooks with the median price target for the S&P500 coming in at high single digits. The key themes of these outlooks are:

- While valuations are expensive, they can remain there if earnings growth maintains its current trajectory

- The US is expected to outperform the rest of the world from an economic perspective

- Earnings outlook remains strong, with the AI infrastructure build-out still in its early stages. Deregulation and potential tax cuts will be a further driver of growth.

As we head into 2025, here are some of the themes we believe will dominate portfolios

1. New Zealand’s period of underperformance may end in 2025

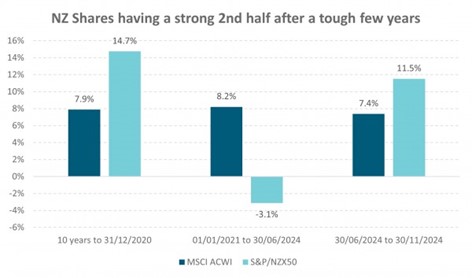

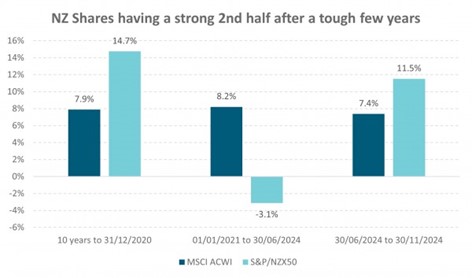

The New Zealand share market has rallied so far in the second half of 2024, outperforming the MSCI ACWI. Market observers know to respect price moves as collectively signalling turning points. The New Zealand equity market was a world leader in the decade to 2020, as low starting valuations combined with steady economic growth and a generally falling- to low-interest rate environment. There were some specific leaders, a2 Milk, Mainfreight and Fisher & Paykel Healthcare, that all provided evidence that New Zealand companies can win on the global stage.

Three years ago, the starting valuation of the New Zealand equity market was close to 30x earnings. Expensive by most measures, the New Zealand market was susceptible to the impact of higher interest rates. The market de-rated to a valuation of closer to 20x, and the median stock valuation fell further to almost 16x earnings. The recent economic recession and higher interest rates have bitten into sales so margins and net profits for many cyclical companies have been downgraded sharply. We think the earnings cycle may be forming a bottom.

Further, to the extent that it impacts the more domestically focussed companies, business surveys are showing signs that the economy is responding to lower rates. Supported by renewed M&A (merger and acquisition activity), we think that domestic institutions are underweight the local market, and Australian institutional positioning is also subdued. Better valuations, lower interest rates and underweight positioning suggests we may get a follow through in demand for local shares.

Source Bloomberg, S&P, MSCI

2. Tariffs, Taxes and Trump.

Changes to US economic policy represent some of the biggest risks and opportunities to financial markets in 2025. Trump will be inaugurated on 20 January and has promised several changes that are likely to support US growth, including deregulation, tax cut extension and additional tax cuts. Immigration into the US is likely to drop a lot under Trump and may be inflationary via reduced labour supply placing upward pressure on wages, but most expect deportations to be much less than promised during the campaign. He has pledged tariffs of 25% against Canada and Mexico, along with an additional 10% tariff on Chinese goods – measures that are likely to add to US inflation and reduce global economic growth, particularly if these countries respond with tariffs of their own on US imports.

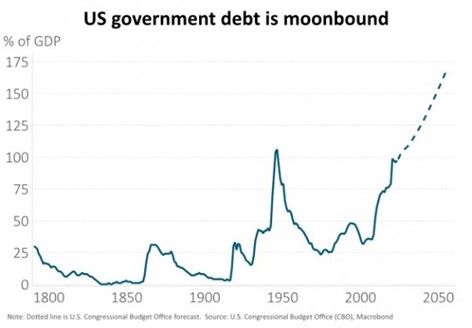

Markets appear to be adopting a wait-and-see approach for now, particularly after the appointment of Scott Bessent as Treasury Secretary who may help moderate increases in fiscal spending and use of tariffs. Bessent is a hedge fund manager known for supporting fiscal restraint and inflation targeting – a much-needed influence given the likely sharp increase in US government debt over the coming year (see chart below). While the pledged tariffs are much larger than expected for Canada and Mexico, they are much smaller than expected for China. Many analysts cite his previous use of tariffs as leverage to get new trade deals with Canada and Mexico. There is also a view that Trump would likely soften his tariff stance in the event of equity market weakness as he would see this as a reflection of deteriorating economic prospects. In the event of trade tariffs, many expect China to expand stimulus measures, but these are unlikely to provide a complete offset from a global growth point of view.

3. What if US exceptionalism does not continue?

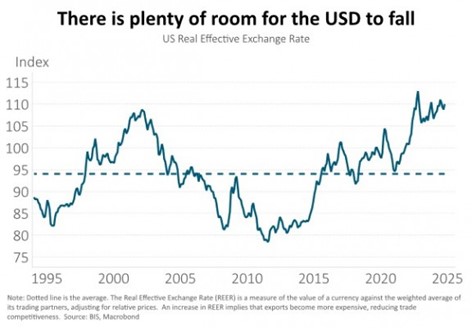

Most analysts forecast the US economy to outperform the rest of the world in 2025, allowing the USD to remain expensive with little USD weakness expected by the median forecaster. The US economy is expected to grow 2.1% in 2025, almost double the growth expected in the euro area, Japan and the United Kingdom. Effective interest rates, however, are still rising in the US, placing downward pressure on consumption. Trump’s economic agenda carries stagflationary risk if he is to prioritise tariffs, restrict immigration, reduce Fed independence and seek a weaker USD. In these types of environments, the currency has plenty of room to depreciate. On a real trade-weighted basis, for example, the USD is almost 15% above its 30-year average (see chart below). We think this provides a supportive backdrop to run higher currency hedging ratios for global shares at

current levels.

4. Can Australia remain the lucky country?

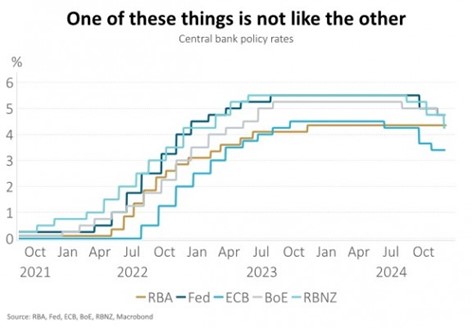

Australia may have yet again proven itself to be the lucky country, avoiding recession when many others have not been as fortunate. It is widely recognised that the Reserve Bank of Australia (RBA) left interest rates too low for too long, resulting in persistently high core inflation that means its rate cutting cycle is unlikely to begin until April next year – 7 months behind the US Federal Reserve and 10 months after the European Central Bank (see chart below). In the meantime, households continue to feel the pinch of lower real wages and high mortgage rates. Pressure is building on the housing market as these dynamics combine with declining population growth to cause some of the first house price declines in Sydney and Melbourne that we have seen this cycle.

RBA reticence to lift interest rates has also created a dilemma for Australian politicians ahead of the 2025 federal election. They recognise that inflation is not yet re-anchored but also want to address the cost-of-living crisis. The recent announcements of student debt relief and energy rebates speak to this pressure. Interestingly, the energy rebate will likely reduce headline inflation to within 2-3% target band and may allow rate cuts to happen ahead of the election.

5. Has inflation sustainably returned to 2%?

Probably, is the message from economist forecasts and market prices, but the risks are skewed to higher inflation outcomes. Economists forecast US core inflation to be 2.2% in 2025, and the market-implied breakeven inflation rate is around 2.5% (the difference between Treasury Inflation-Protected Securities (TIPS) and the non-inflation protected equivalent). It is important, however, to recognise that the main driver of recent disinflation has been tradable goods deflation as global supply chains and energy prices have normalised. In NZ, for example, tradable prices, which represent 40% of the CPI basket, dropped 1.6% over the year to Q3. Domestic, non-tradable, sources of inflation for much of the developed world are yet to normalise, leaving core inflation well above pre-COVID levels. Ongoing labour market loosening should deliver lower rates of wage growth but for now US wages are continuing to grow at 4% y/y, vs. 3% pre-COVID. It’s the same story in NZ with productivity-adjusted wages growing at more than 3% y/y, vs. 2% pre-COVID, keeping non-tradable inflation at almost 5% y/y.

A global trade war is an obvious risk to further progress on re-anchoring inflation and inflation expectations. In the US, Trump’s pro-growth policies are likely to place upward pressure on inflation and limit the degree of further Fed easing. Longer term, changing structural inflation forces may create even greater uncertainty for investors, including de-globalisation, demographics, and de-carbonisation.

6. Why equity returns probably will not be high single digits.

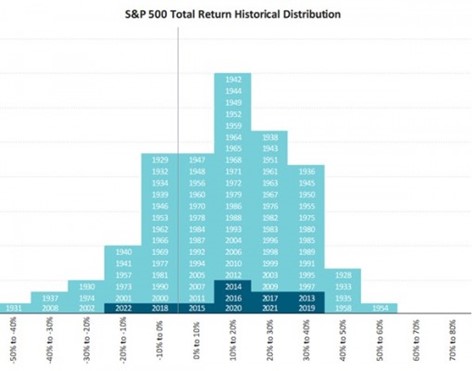

Browsing many sell-side forecasts, many see the S&P 500 returning circa 8% from current levels. While this is entirely possible, it reminded us of one of our long-term returns charts which plots calendar year returns. While the return from US equities since 1928 (when our records begin) is 9.8% per annum to the end of 2023, the number of times US equities has returned between 0 and 10% since 1928, is only fourteen times. In other words, history tells us that 86% of the time the annual return for the S&P 500 is outside the range of 0 – 10%. In fact, 0 – 10% has only been the 3rd-equal most common outcome.

7. Climate impact on AI intensifies

2024 is on track to be the warmest year on record according to the World Meteorological Organisation (WMO), even warmer than 2023 which currently holds the record. 2024 is also on track to, quite significantly, be over 1.5 degrees warmer than pre-industrial levels, the level the “Paris Agreement” which came into effect in 2016 tried to avoid. While recent science has pointed to some temporary factors that may have impacted temperatures in 2024, if the trajectory does not change, scrutiny will no doubt intensify on high emitters.

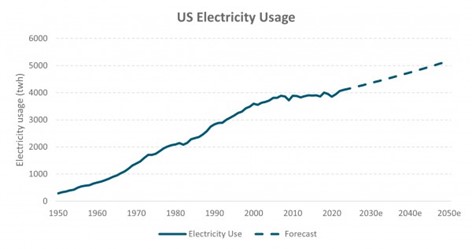

Electricity usage in the US was flat from 2007 – 2022, however the U.S. Energy Information Administration (EIA) is predicting a step change. AI and data centres are expected to represent about half of the increase with Electronic Vehicles (EVs) the next largest contributor. Given EVs will be displacing fossil fuels, one would expect AI and data centres (though some of this is displacing on-site servers) to attract the most attention. This problem is particularly acute when renewable energy still only accounts for a little more than 20% of the US electricity grid.

Large hyperscalers such as Amazon, Alphabet and Microsoft have already come under pressure for the environmental impact of their actions though, so far, have been behaving responsibly as covered in a paper by one of our global equity partners, Epoch Investment Partners.

“…Despite the negative implications of AI for carbon emissions, the big hyperscalers are serious about meeting clean energy commitments and exhibiting net zero carbon footprints. The tech titans prefer carbon-free electricity and can easily afford a price premium, which implies more renewables coupled with battery storage. While some degree of skepticism might be warranted, we largely take their net zero pronouncements both literally and seriously. Moreover, we believe they will commit massive capital to this space.

To illustrate, one of the tech giant’s emissions were up 30% from 2020 to 2023, highlighting the challenges associated with meeting climate goals while building out DCs. In response, the company and a big infrastructure investor announced on May 1 a groundbreaking $10 bn deal to build 10.5 GW of renewables capacity by 2030. The intent of the tech behemoth is to procure 100% of its electricity, 100% of the time, from zero-carbon sources by 2030.

As a second example, in March, another tech giant paid an energy company $650 mn for a 960-MW DC in northeastern Pennsylvania. This DC is directly powered by the adjacent Susquehanna nuclear power plant which, at 2.5 GW, is America’s sixth largest and is licensed to operate through 2042 (it has been online since 1983). The company’s explanation for the acquisition is that “we’re on a path to power our operations with 100% renewable energy by 2025”…”

AI and Electricity Demand: The Very Hungry Caterpillar. By William W. Priest CFA, Kevin Hebner PhD, Michael Jin CFA.

Source: U.S. Energy Information Administration (EIA)

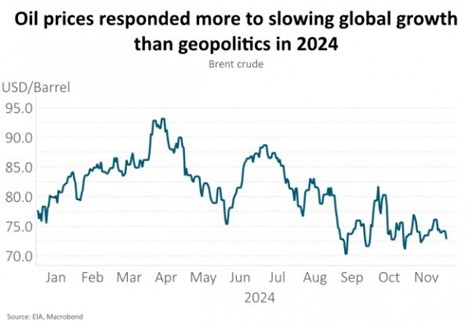

8. Will macro continue to beat geopolitics?

2024 was not short of geopolitical events but, at the end of the day, it was global economic developments that dictated the market narrative. Energy and oil prices, for example, have responded more to the slowing global economy and additional oil supply than the ongoing conflict in Ukraine or the intensifying situation in the Middle East.

2025, however, could be different. The conflict in the Middle East continues to spread, with Iran oil facilities a possible target. Iran produces about 3% of global oil supply and UBS estimates further escalation could lift Brent oil prices to as high as US$90/barrel, 30% above September 2024 lows. This may create a dilemma for central banks that would normally look through a temporary supply-driven increase in inflation but may be less comfortable with inflation not yet anchored at target. Elsewhere, incoming US President, Donald Trump, is pledging tariffs that risk a global trade war but also saying he would work towards a quick end to the war in Ukraine. A global trade war is unambiguously negative for global growth. News of a ceasefire in Ukraine could see natural gas and oil prices fall as markets anticipate a partial return of Russian supply energy supply to Europe.

9. Is 2025 the year NZ invests more in private markets?

As the world has invested more and more into private markets, New Zealand has been a notable laggard. As can be seen below, some 18% of superannuation FUM in Australia is allocated to private markets and alternatives. In the US, Public Pension Plans had allocated 34% of their holdings into alternative assets. The average KiwiSaver growth fund allocates around 3% (across “other” assets and unlisted property).

However, we may be reaching a tipping point due to a combination of factors. Firstly, private credit has emerged as an asset class, with multiple funds available in New Zealand and a bank capital backdrop that could see more lending made in private hands. Secondly, the New Zealand venture capital (VC) landscape is growing in maturity and the number of successful exits is increasing. So far in 2024 we have seen the successful sale of Tradify and Kami, delivering significant added value to shareholders. Lastly, given the starting point for equity valuations, our own expected equity market returns are lower as are the returns of many research partners and managers we have relationships with, which increases the allure of alternative return sources.

Source: APRA Quarterly superannuation industry publication, Sorted Fund Finder – Growth option.

10. Beyond the horizon risks may also emerge in 2025 as influences on markets.

Bird flu, an acceleration of climate change, solar flares and, on a positive front, a break-through in nuclear fusion are among the many low probability but high impact events that could occur.

- The highly pathogenic H5N1 avian influenza strain arrived in New Zealand, posing a significant threat to poultry farms, and wild bird populations. Last week in the US the Secretary of Agriculture mandated that the national milk supply is tested for bird flu, with more than 500 dairy herds now infected. In the US, almost 60 people have contracted the virus since April, most of them workers on infected poultry farms, but the symptoms are mild and the US CDC continues to note that the risk to the general public from bird flu is low.

- Temperatures and extreme weather events continue to escalate, with the recent flooding in Spain providing a global example, and forest fires in Canterbury highlighting the risk of high temperatures and strong wind.

- The risk from solar flares is expected to increase in 2025 as the sun reaches the peak of its 11-year activity cycle. Powerful solar storms could interfere with satellites, disrupt GPS systems, and potentially cause temporary blackouts in power grids. This could affect various sectors, including communication, transportation, and energy distribution.

- Commercialisation of nuclear fusion remains very uncertain, however global breakthroughs in nuclear fusion, and our own OpenStar breakthrough continue to point to the potential future (perhaps still distant) opportunities from technology. On that note we continue to consider that not all risks are negative, with many tail events potentially reaching toward positive advancement.